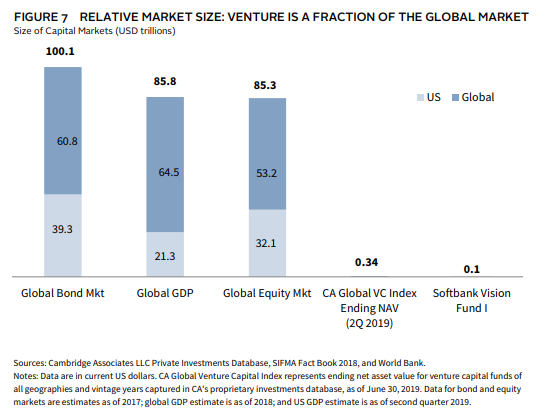

VC at $340 billion net asset value is less than 0.5% of the $85 trillion in global equity valuation.

Over the last two decades, we have seen massive disruption, reshaping of industries, and the creation of trillion-dollar market cap tech companies. Over the last three months, we have seen trillions wiped out in the markets as the 11-year roaring bull got struck down with COVID-19, subsequent rallies, and now we likely head into the counter-cyclical environment many have long anticipated.

What does that mean for founders, investors, and Ireland? Understanding this is the start, and looking forward is the challenge.

I arrived in Act in 2018 and have become fascinated by the craft of venture capital, the future of innovation, and the people determined in building it. It is a firm with a 26-year history of backing innovation in both good times and bad. I have an appreciation that this craft is not learned overnight but rather over decades and cycles of booms & busts.

As someone who always enjoyed history, I like to understand through patterns and learn through phases & cycles. I kept hearing about a book called Technological Revolutions and Financial Capital by Carlota Perez from lots of respected people in VC, and it is worth summarising.

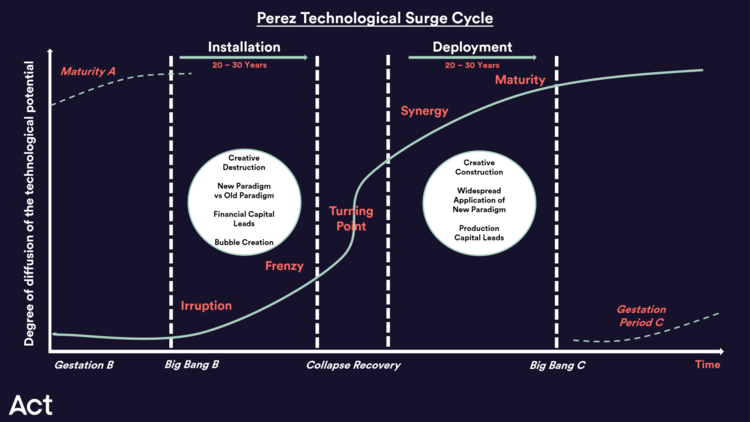

Perez charts the five great waves of innovation of the last 240 years: The Industrial Revolution, age of railways; the era of steel and heavy engineering; the world of the automobile and mass production, and then, from the 70s, starting with the big bang moment of Bob Noyce, Gordon Moore and the microprocessor – the age of information and communications technology.

These cycles of tech revolutions are coupled with financial cycles. Each cycle, which may take 50 – 60 years, consists of the following four phases.

Irruption phase Intense funding of innovation. Clusters of new revolutionary inventions appear. New industries are established, and the construction of new infrastructure starts.

Frenzy phase Increased speculation and financialization leads to a decoupling between financial capital and production capital. Capital is invested more in financial innovations than in technological innovations. Asset bubbles are inflated.

Synergy phase Growing inequality and political unrest. A need for political regulation of the financial sector is acknowledged. Asset bubbles may burst. The link between financial capital and production capital is repaired.

Maturity phase The market for the new technology begins to become saturated. Social structure and infrastructure have adapted to the new technologies. Opportunities for investment are decreasing. The idle financial capital is moving to new sectors and new regions where it may lay the foundation of the next great surge.

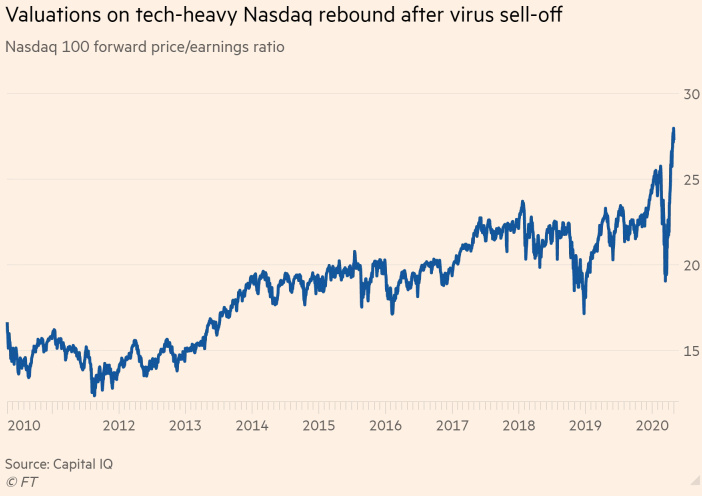

Understanding the frenzy phase and synergy phase across these waves is intriguing…but after the fact. What phase are we in, and what use can it be to the investor, and where does a pandemic fit into this?VCs are unique in the world of finance. Funding uncertain projects that operate in fast-moving environments with constantly moving technological paradigms. Founders are developing products they may not have a full vision yet, for customers whose needs may be opaque. In the simplest of terms, VCs are looking for clarity & context to make thesis-backed decisions on people, markets, and technology, while applying the power law in pursuit of the outliers, to achieve outsized returns. Understanding phases, waves, and market shifts over time is key to this. The first thing to note is that COVID-19 is fundamentally a medical crisis, not a financial one like the 2008 financial crisis. Even more obvious is that it has nothing to do with technology like the dot.com bust…if anything is interesting to note how tech-friendly this recessionary period has been with society kept inside – Amazon, Netflix, and Zoom becoming the obvious notable beneficiaries

Perez argues every wave has taken several decades to spread across the economy. The first few decades are a huge experiment to learn the new technologies; they are times of ‘creative destruction’, of booms, bubbles, and crashes. Pandemics are a different animal, but like the previous world wars, they can force faster innovation, may accelerate the curve, and provide strong tailwinds. In fact in Satya Nadella’s recent earnings call on Microsoft he mentioned;“We have seen two years’ worth of digital transformation in two months”.In the latest wave, she says, we have gone through the dot.com bubble and the global financial crisis of 2008 and now presumably – COVID…? The crashes are followed by a recession or setback when typically, all the victims of those bubble times are angry and follow populist leaders advocating change…to the left or to the right…sound familiar? But the possibilities and foundations for a golden age and the next wave are essentially there.

The infrastructure is in place, be it waterways and locks, rail tracks and roads, electricity or fibre optics, or 5G and cloud computing. The basics for innovation have been figured out. Perez now places the IT era at the point where its golden age can be reached. But it requires, as in every previous wave charted across the 240 years, a proactive forward-looking government that will tilt the playing field in directions where both business and society can win. In Ireland, the last decade has seen a wave of innovation from homegrown start-ups and a developing ecosystem. Over the last two decades, Ireland has had unmatched levels of FDI from the global leaders in the technology industry. I could dive into who these are and the details here, but we all know the characters in this story. The highlight is that these waves have been initially created by the government, in the shape of Enterprise Ireland, NTMA, EIF, and IDA. One of the key takeaways I took from Perez was that historically the responsibility for directing innovation rests with the State. It must set the tempo, build the springboard, and write the rules so that private enterprises can be sustainable, profitable, and create lasting socio-economic benefits. In a post-pandemic economic resuscitation, this is even more paramount.

What does this mean for Ireland’s founders and investors?

We can reach for economic prosperity, maximum productivity, and whatever else technology and innovation will emerge in this decade. With strong government support, Ireland can get through this and reach a new way of life with increasing skills, diversity, flexible patterns of work, and enter a golden era of innovation in the next decade. In Act, we are always asking what are the conditions, criteria, and variables that need to align for this company (and the market it operates in) to achieve strong growth and become an exceptional company. With the core infrastructure in place, we still see companies in Ireland primed to become truly global and transformative to their industry. In Q1 2020, we continued to support Cubic (€11.1m), Ekco (€8.4m), Gridbeyond (€10.5m), Silvercloud Health (€15m+), and Buymie (€2.2m) who raised a combined c.€47m. What do Cubic Telecom, Ekco, Gridbeyond, Silvercloud, and Buymie have in common? They are fundamentally changing their industry, and we are backing them to do it. Cubic is looking to connect every vehicle in the world, Gridbeyond is optimising energy consumption, Ekco is on a mission to be Europe’s largest cloud services platform, Silvercloud is curing depression & anxiety with its digital health platform and Buymie wants to change how we shop for groceries. These founders have global ambitions from the start, to build enduring global companies and we are backing them to do it. The Irish tech sector although visibly shaken like everyone had some good news earlier in the year on the back of Ireland’s largest ever venture-backed exit; Decawave. There is a core infrastructure, availability to capital, and an evolving ecosystem within Ireland, that has emerged in the last decade that is creating the conditions for success on a much larger scale than available previously.

Why are we at an inflection point?

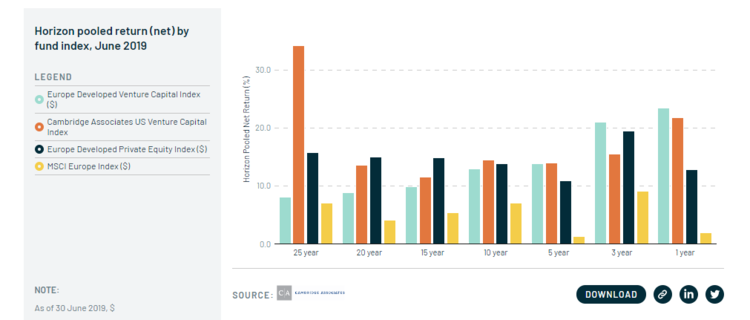

1.There is smart money. There is more smart institutional capital available in Europe than ever before for founders. Capital from LPs (our investors) in Europe set a new record in 2019 at €11.2bn and is strong overall, with four of the past five years nudging over the €10 billion mark. Why is this happening? because European funds have been doing well. These funds typically have ten-year life span (5 investing / 5 realising), and funds that have raised in the last 3 years, still have the dry powder out there waiting to be deployed through or after COVID.”European Venture Capital is a deep and profitable Asset Class with 50 funds returning more than 20% Net IRR and 3rd quartile funds of recent vintages being in positive territory“Nicolas Perard 🇪🇺 (@NicolasPerard), September 25, 2019

The data shows that European VC returns are now globally competitive and that has caused LPs to wake up. On a 1, 3 and 5 year horizon, Cambridge Associates data, shows that its index for European VC performance is either on par or significantly outperforming indices for both US VC and, importantly, European Private Equity. Of course, we are only the supporting actors in this story…Funds only perform well because of the talented founders in their markets, creating great companies. Europe and Ireland are seeing this talent, and with the right investors, more start-ups are scaling faster on the path to the elusive unicorn status with 50+ 100M rounds and 6 rounds of 500M+.

Only 5 years ago these were unheard of, but the funding gap is now rapidly closing with the large mandate from the EIF and other state actors to support innovation. Furthermore, the experience of this smart money is beginning to compound with funds like Act, across Europe now on their 5th, 6th or 7th + fund building on 2+ decades of company building to support founders as they navigate through the roller coaster ride of start-up life, the scaling journey and now potentially turbulent economic times. The latest figures calculate there are 3,000 VC funds in Europe, across all stages from Seed – Series D with 2,604 unique investors participating in a venture round in 2019. There is a real fear that there is too much money being raised in VC… I would argue this fear is born out of looking back and contextualizing it based on historical levels, rather than again looking forward to the future potential. How do the numbers stack up? The funds raised by VC represents a tiny fraction of the market value of the industries being disrupted by many VC backed companies and an even smaller amount of the total addressable markets of emerging categories being created by VC. An interesting fact; VC at $340 billion net asset value is less than 0.5% of the $85 trillion in global equity valuation.

2.The worst kept secret in Europe – Top Tier US firms are putting boots on the ground. I sat listening to Michael Moritz at Slush last November, who said they have always been in Europe, and all founders needed to do was drop him an email…In truth, they have always had the ability to invest globally but European founders would fly out to Sand Hill Road and set up shop in SF. Two well-documented examples and incredible companies; Stripe & Intercom. What’s changed? US firms have boots on the ground and Sequoia has made their first key hire to be physically present in Europe. They may slow things down in the short term but these are long term investors looking for long term value creation.

In fact, more recent early-stage European funds are attempting to benefit from this development, by branding their approach wholly different to their European peers, by adopting “the Silicon Valley” mindset and focusing on building relationships with later stage US investors. This new approach is not without merit, but traditionally, established investors haven’t had to compete at an early stage with all seed and Series A investments comfortably dominated by European investors. The next phase may bring more collaboration in how early-stage funds interact with later stage US top tier firms, but as Saul Klein from Local Globe says well; “Smart founders understand that you want investors who are not absentee landlords and can sit down and meet you,”. Established locally present investors can provide the early-stage value, experience, and have the network to the later stage investors for when companies are ready.

3. Founders are hanging around longer. Historically Europe and Ireland have suffered from the stigma of selling out early. I have heard so many stories from the team here, that they only wished that the company said no to the acquisition offer and kept going. However, this phenomenon is decelerating with many founders in Europe now going the distance in later stage rounds and what is seen as a cultural shift at the turn of the new decade. Persistence pays off. The European ecosystem created exit value of $107 billion in 2018 which almost exceeded US exit value. More intriguing is that these exits are spawning secondary momentum in the form of experienced scalers tackling big categories with, ex-Revolut, ex-King, ex-Spotify and ex-Deliveroo teams and more launching start-ups in the last 18 months. We have seen these powerful secondary effects for decades in the US with the NY Times chronicling Uber and Airbnb Alumni Fuel Tech’s Next Wave and the “Silicon Valley’s often-incestuous circle of life”. Although arguably, they have been at this for a while….in the 50s, Fairchild Semiconductor, one of Silicon Valley’s earliest successes, was started by a group of disgruntled Shockley Semiconductor employees called the Traitorous Eight.

What we need to focus on this decade, is how we see this ripple effect in Ireland. We have Facebook, Amazon, Apple, Google, Zendesk, Hubspot, Dropbox, Uber, Airbnb, Salesforce, Stripe, Docusign, Workday, and Slack in Ireland…with Tines.io being a great example of what this rich talent environment can produce…and these secondary effects must be combined with incubating ambitious domestic startups and growing to scale-ups and beyond to deliver lasting returns for the country. Bigger companies allow for bigger outcomes and will force a cultural shift to allow for huge potential of compounding second-order effects. It will also provide a better playbook for starting in Ireland. On top of the inspirational figureheads that will influence the next generation of founders.

As a larger region, Europe is beginning to show the emergence of the golden age and a new wave of innovation. It was on track to hit 100 unicorns with key competencies in fintech and enterprise SaaS and deep tech maturing as a business model. This may change now given the current climate…but the significant point is that these companies are becoming more geographically distributed across all of Europe, and Ireland has a big part to play in this story. London still sits top of the pile, of European tech hubs, but with a new focus for regions to incubate developer talent and Ireland now being the only native English speaking country in the EU, there is an opportunity to attract start-ups and lean teams who do not need nor desire London to be a must-have on the journey for growth. In our own portfolio, Visua is one such example of European founders; Luca & Alessandro settling on Dublin to build & grow a great company.

What’s needed to harness this potential? It’s obvious Ireland still has so much potential, Europe as a region is starting to deliver on its promise, and the world has taken notice.

1. VC – A more established and comfortable asset class In 2002 Act VC raised a €170m fund. At that time, this was the largest venture fund in Europe. Large pension funds began to show an appetite for venture, and the Irish ecosystem it turns out was not quite ready. It could be argued we were pre-deployment phase. Since then VC has accelerated dramatically in Europe over the last decade but is still behind the US and Asia. The lower-risk appetite from large European institutions such as pension funds have for VC as an asset class despite strong returns at EU level, can perhaps be a force at play here. Cambridge Associate’s recent article on “venture disrupting intergenerational investing”,states “It is important for private investors to understand how the return and risk profiles of VC investing have changed, as today’s market is not the same as 20 years ago. Broad-based value creation across sectors, geographies, and funds means success is no longer limited to a handful of fund managers”.This is, of course, a US firm, speaking to a mainly US audience of pension funds, family offices, and endowments that allocate patient capital to venture as an asset class and suggesting up to a 40% allocation. They are more than comfortable with the risk and long-term returns it will provide over a 10-year lifecycle.Perhaps we should be listening more attentively.Although the state plays a vital role in supporting innovation, the next wave in Ireland and Europe also requires a more diversified LP base with more private enterprise that can add significant expertise to early-stage company building. As most LP funding in Ireland and the EU still comes from our governments, fund of funds, corporates, and banks.

2. Developing technical talent and tackling diversity is Ireland’s challenge and opportunity. The first-ever computer science leaving cert exam was due to take place this year. In order to look for phases, we must try to spot the trends at the intersection of developer talent and capital invested in Europe and Ireland. Overall, Europe has more developers than the US, it is unrivalled in talent density with 6.1M developers as compared to 4.1M in the US which has been flat for the last two years. Ireland has 78,600 developers and $440m invested in 2019. The UK has 849,600 developers and $11.1bn invested in 2019. That’s $5.6m per dev in Ireland and $13m per dev in the UK. We have more to do. The UK is mature, and future development in the UK may be slow linear growth. Ireland with the state infrastructure and developing ecosystem in place presents all the markers of exponential growth potential. If Ireland can deploy more meaningful levels of capital earlier, further develop regions and unlock the other half of our talent base, we can achieve real diversity, gender equality, and real prosperity. It’s a sobering fact that women make up more than 53% of our 3rd level graduates and receive less than 10% of funding. Even more stark a figure… the 1 female CTO, out of 119 CTOs working at VC-backed European tech companies that raised > $10M of funding. We have some exceptional female-led companies like Tandem, AQ Metrics, Madme, and GoContractor, but most certainly more needs to be done.

3.Tap into Ireland’s cultural identity and paying it forward. A culture of entrepreneurship is deeply embedded in the US. In Tom Nicholas’s recent book “A history of VC”, he charts how VC has been driven from the start by the lure of outsized returns through a skewed distribution of payoffs—a faith in low-probability but substantial financial rewards that often rarely happen. Whether the gamble is a whaling voyage setting sail from New Bedford or the newest start-up in Silicon Valley, VC is not just a model of finance that has proven difficult to replicate in other countries.It’s a state of mind. Demonstrated by an appetite for risk-taking, a spirit of adventure, and a quest for outsized returns through investment in innovation. More incentives and safety nets are required to ensure domain experts and computer science graduates can launch start-ups directly from our universities or corporations into a buoyant and well-funded Irish market, but the appetite for risk-taking and entrepreneurial spirit needs to be encouraged, celebrated and baked into our culture.The reaching out and paying it forward mentality is growing stronger in Ireland and Europe, but our US peers are almost insufferably helpful. Inexperienced founders are in a position where they can benefit from mature founders who have expanded and scaled globally. One of the benefits of being a multistage investor is that we can connect the pre-revenue first-time founder to the repeat founder who has scaled global businesses…save some heartache, create a network of supporters and build lasting relationships. We need more supporters.

What will happen next?

As the world’s most experienced investor Warren Buffet said at the recent Berkshire AGM;“We do not know exactly what happens when you voluntarily shut down a substantial portion of your society.”In the long term, COVID-19 aside, exceptional Irish companies will grow bigger and faster than ever before.We can acknowledge that (in technology terms) Europe has been in new territory and Ireland has a big role to play in its future. The state and government agencies firmly have their hands full right now, but will play major roles in the coming decade in the creation of innovation. The next wave perhaps accelerated by COVID possesses all the necessary components and momentum to deliver truly great global companies and thriving diversity, but the reality is COVID aside Europe is still fragmented, and Ireland has an underutilised talent base through a lack of diversity.The tide though is beginning to turn… The challenges are real, but stepping back, studying the patterns, phases, and the speed at which this wave has been emerging, is accelerating fast.At Act, we have been through the dot.com bubble & burst and had all the experience of being in fundraising mode during the financial crisis. The guys got through it by backing brave founders who dig deep and have resilience in hard times.

Great companies and great resilience emerge in times of uncertainty and bear markets present exceptional opportunities.

You could easily assume that the best time to found a startup is during the good times when markets are only going up. VCs are generous on terms, and it seems everyone is quitting their comfy corporate jobs to launch or join a budding startup. The data may paint a different picture. While not all great companies are created equal, they are created in all markets, with some of the biggest names in tech being formed and funded during tough economic times: Stripe (‘09), Uber (‘09), Airbnb (‘08), Square (‘09), Adobe (’82) to name just a few. Again you could easily argue, the good times may be a worse time to launch. Why? competition for talent; salary levels; office costs, solicitors, consultants and advisor costs at all-time highs; housing market challenges; ever-increasing rents and living expenses for staff; tax and regulatory burdens; we could go on…As mentioned previously, unlike the dot-com bubble & burst, the current crisis has nothing to do with technology.

The tech IPOs of recent that didn’t impress the public markets had more to do with the underlying fundamentals of those businesses. The appetite for the sector is strong, but not for wholly unprofitable companies with questionable unit economics, poor management & governance, still-unproven business models, and for some…very little underlining technology. While a bear market may encourage investors to have a higher level of scrutiny for such practices— and, in some cases, to conduct deeper due diligence — it could force the sector to reset and only back great founders with robust business models and sound unit economics.

The guys raised a €22m seed fund in 2011 right in the midst of a recession with long term partners; AIB, to back resilient founders and companies like Trustev, Soundwave, Feedhenry, and many more.Its obvious we still have the most serious medical crisis of our time on our hands. However, a new wave of innovation was appearing before COVID-19, and we are still seeing great innovative early-stage companies coming out of Ireland (although now through zoom…) In Q2 2020, we have invested in some new (soon to be announced) very exciting companies across both seed & expansion stage, and doubled down on some great progress in our portfolio.This is why we are looking to invest in and support more visionary and ambitious founders in 2020, to support Ireland’s next wave of resilient start-ups and founders.

In the words of Alan Turing,“We can only see a short distance ahead, but we can see plenty there that needs to be done”

The Diversity VC Standard is an assessment and certification process that sets a benchmark for best practice on Diversity and Inclusion (D&I) in VC and sends a signal that a fund follows best D&I practices to the rest of the ecosystem.

For 26 years, Act has always focused on investing in people first and foremost. We are living in a society with an ever-increasing richness of diversity, yet the venture capital industry, in terms of investors and the founders they invest in, does not reflect this. We are committed to acting now to close the gap and focus on accessing an untapped talent pool. Ensuring diversity in Act and encouraging diversity in the investment community. It is only when diverse perspectives are included at the decision stage, that teams can overcome groupthink and cognitive bias, make better decisions, and ultimately maximize returns.

There is clearly work ahead to make this correction and find an equilibrium, and the VC industry can have a multiplier effect. We build our teams, we decide on the people we want to invest in, we help our teams to grow and hire, and have a responsibility to the wider ecosystem within which we operate.

We have always been wary of tokenism in our industry and had spent some time assessing the Diversity VC Standard. The idea essentially is to create a detailed standard of processes and policies that have been shown to improve diversity in everything that a venture firm does – hire and retain talent, make and manage investments, and work with founders and teams who want to build exceptional and enduring companies.

The Standard is a process of assessment and annual audits, some technological, some human, to really understand how we measure against the industry. It allows firms to understand where they are weak, provoke hard questions, and drive for change.

That’s why after spending time reviewing the standard, we made the commitment to the Diversity VC Standard for D&I and are proud to now have attained the Level One standard.

Here are some of the measures or initiatives that we were either already running or have initiated in order to meet this standard:

– Introduce a transparent, anonymized, and open hiring process

– Measure the levels of diversity and inclusion within Act and our portfolio of companies

– Develop and document diversity and inclusion best practice including research into the D&I strategies of the best performing tech companies

– Introduce a new D&I assessment at the evaluation stage on D&I policy and hiring practices

– Appoint a Chief Diversity Officer and draft a new Diversity and Inclusion statement

– Reach out and build relationships with community groups, local & regional education institutions to deliver in-person sessions and related content that inspires and educates people from a wide variety of backgrounds and demographics on Venture Capital and the wider technology industry

While we are proud to have reached the Level One standard, we recognise that this is only the beginning and that there is much more work to do before we, as an industry, start to materially change the metrics and culture.

About Diversity VC Standard & Diversio

The Diversity VC Standard is an assessment and certification process that sets a benchmark for best practice on Diversity and Inclusion (D&I) in VC and sends a signal that a fund follows best D&I practices to the rest of the ecosystem.

Diversio is the people intelligence platform that measures, tracks, and improves diversity & inclusion.

This year, we celebrated the 25th anniversary of Act. And as much as our industry, business and the world has changed over those decades, it is amazing how venture capital fundamentals remain consistent throughout cycles. The way we practice investing and add value in the industry has evolved over time, but our core principles have remained constant since 1994.

Team & Principles

We’ve built our team and our culture around these principles. To encourage transparency & deep understanding, and by putting the team ahead of the individual, we aim to develop great investors from within our firm. Acting on principles, is evidenced by the fact that our partners have been successfully investing together as a team for over 2 decades. Where all three partners started as associates, eventually growing into their partner roles.

We value teamwork and true expertise over showmanship. Our team is small, but our expertise and knowledge is diverse. Our global network is vast, having being built over decades of hard lessons learned, goals achieved and relationships formed.

Working as a team is central to our success, and one way this is reflected is in our preparation and our focus. This means doing the ground work and developing deep understandings on current technology and market dynamics, and sharing them across our team. Our preparation has led us to find innovative technology companies led by extraordinary teams.

Our focus and ability to take a company from seed to exit enables us to build strong trusted relationships with our founders and focus on what really matters, filter the noise and use our expertise to guide and support these founders and teams to build daring companies.

Diligence & Preparation

In an ever changing industry, our primary focus on prepared and diligent investing enables us to have firm conviction to back extraordinary teams and companies in the very earliest stages in their journeys. Over the last decade, Act has been Ireland’s most active VC investor; with 53 new investments and 43 exits.

– Raised 5 funds totaling €487m

– Leveraged a further €1.2 billion investment from our international network

– Receive 1000+ submissions per year

– Evaluate 200+ investment opportunities annually

Our primary objective is to be the first and lead investor in our companies, that takes pro active, supportive roles with founders, and work diligently side-by-side to build incredible businesses. To remain with them along the journey from seed to exit, by providing investment, support and 20 years of expertise of travelling this journey again and again.

Innovation In Ireland

One of our fund objectives is the development of innovation in Ireland. Investing here is the focal point of our strategy. Act through the support of AIB, Enterprise Ireland, Ireland Strategic Investment Fund and the European Investment Fund has been given the ability to combine a strong investment capacity with vital company building expertise that will directly develop an indigenous industry of innovative technology companies with global reach— we firmly believe that we are only at the initial phase of Ireland’s innovation culture and are here to support the next wave of talented young innovators.

With the same breath we know we must also look beyond Ireland in a world that is becoming more local and accessible, and the explosion of technology startups around the world, has provided us more opportunities to support talented technology founders. We must strive to support the growth of female founders to find another talent pool of entrepreneurs, that are currently misrepresented. With a mandate to invest in Europe and US companies seeking and Irish EMEA HQ, we can add considerable expertise to both early European startups and US companies seeking local expertise.

A hard act to follow : to the next 25

We are more optimistic than ever about the growth of technology in our lives over the next 25 years. In the last 12 months we added two new members to our investment team; Andrew & Vaibhav, had a face lift with a new brand identity and continue to evolve as a firm and team.

Beyond our team, our ability to continually support exceptional founders and companies is largely due to our limited partners, many of whom have supported us for over 20 years. Thank you. We deeply appreciate the opportunity to implement your objectives, and are always conscious and aware of the trust and responsibility that you’ve placed upon us.

Last but not least…we are indebted to the talented and daring teams we have partnered with over the last 25 years, who do the impossible when others doubt, who work tirelessly to build extraordinary companies from an idea. Thank you.

“VC is a people business. For that reason, we have committed to make our code of conduct a vehicle to foster and support people of all groups and minorities.”

Reason Why.

The goal is to create a future that we will be proud of. To look back and see our children enter a fair, diverse and supportive workplace. An environment for people who share our values of tolerance, diversity and inclusivity.

ACT is committed to maintaining the highest standards from staff in their general conduct. This includes a zero tolerance approach to discrimination, harassment, intimidation, regardless of an individual’s age, disability, sex, sexual orientation, race, religion or belief, gender reassignment, marriage or civil partner status, pregnancy and maternity (“protected characteristics”).

Acting Now.

We believe that these standards are the firm foundations to creating a fair working place and therefore expect everyone associated with ACT to abide by this code. This code of conduct applies to all of these people in any setting associated with ACT.

Things we will not stand for.

Discrimination

Direct discrimination occurs when a person is treated less favourably because they, or someone with whom they are associated, has one or more of the protected characteristics set out above, compared with someone who does not have that attribute.

This includes but is not limited to:

Racial or ethnic slurs

Homophobic or transphobic comments or slurs

Treating someone less favourably because of their age or sex

Discriminating against pregnant people or mothers Indirect discrimination occurs when a provision, criterion or practice (PCP) is applied but it has the effect of putting persons with a protected characteristic at a particular disadvantage when compared to others that do not have that protected characteristic and that PCP cannot be objectively justified.

This includes but is not limited to:

A requirement that attendees to an event do not wear garments that cover their face puts people of certain religions with mandatory dress requirements at a disadvantage

Requiring a minimum number of years’ experience to perform a certain role where such a requirement cannot be justified

Holding compulsory team meetings in the evenings when an employee who must care for family cannot attend

Harassment

Harassment occurs when an individual is subjected to unwanted conduct related to a protected characteristic or be of a sexual nature, which has the purpose or effect of violating the victim’s dignity or of creating an intimidating, hostile, degrading, humiliating or offensive environment.

This includes but is not limited to:

Bullying, nicknames

Unwelcome touching or flirtation

Sexual or sexually suggestive comments, jokes, insults, metaphors, pranks or gestures.

Unsolicited questions about someone’s marital or relationship status or sexual preferences, directly or indirectly

Reporting and enforcement

We encourage everyone to report any violations of this code of conduct in writing to our Committee. We expect people to be conscientious in reporting any violations they see, with the consent of the person involved.

Community members can report violations by email to info@actvc.ie.

All information obtained in the investigation will be communicated on a “need to know” basis consistent with a thorough and adequate investigation and appropriate action.

We have internal policies to address grievances and disciplinary issues, and we also have a responsibility towards third parties, as well as legal and regulatory requirements.

In keeping with those requirements and responsibilities, actions we might take in response to a reported incident include but are not limited to:

Verbal or written warning, permanent or temporary ban from certain spaces or suspension from the workplace, removal of responsibilities, termination of employment, report to legal authorities, termination of arrangements with third parties.

Monitoring and reviewing this code of conduct is reviewed from time to time by the HR team. We will continue to review its effectiveness to ensure it is achieving its objectives. We also review our policies with an employment solicitor on a regular basis to make sure that we are in line with the most recent legislation.

Act VC